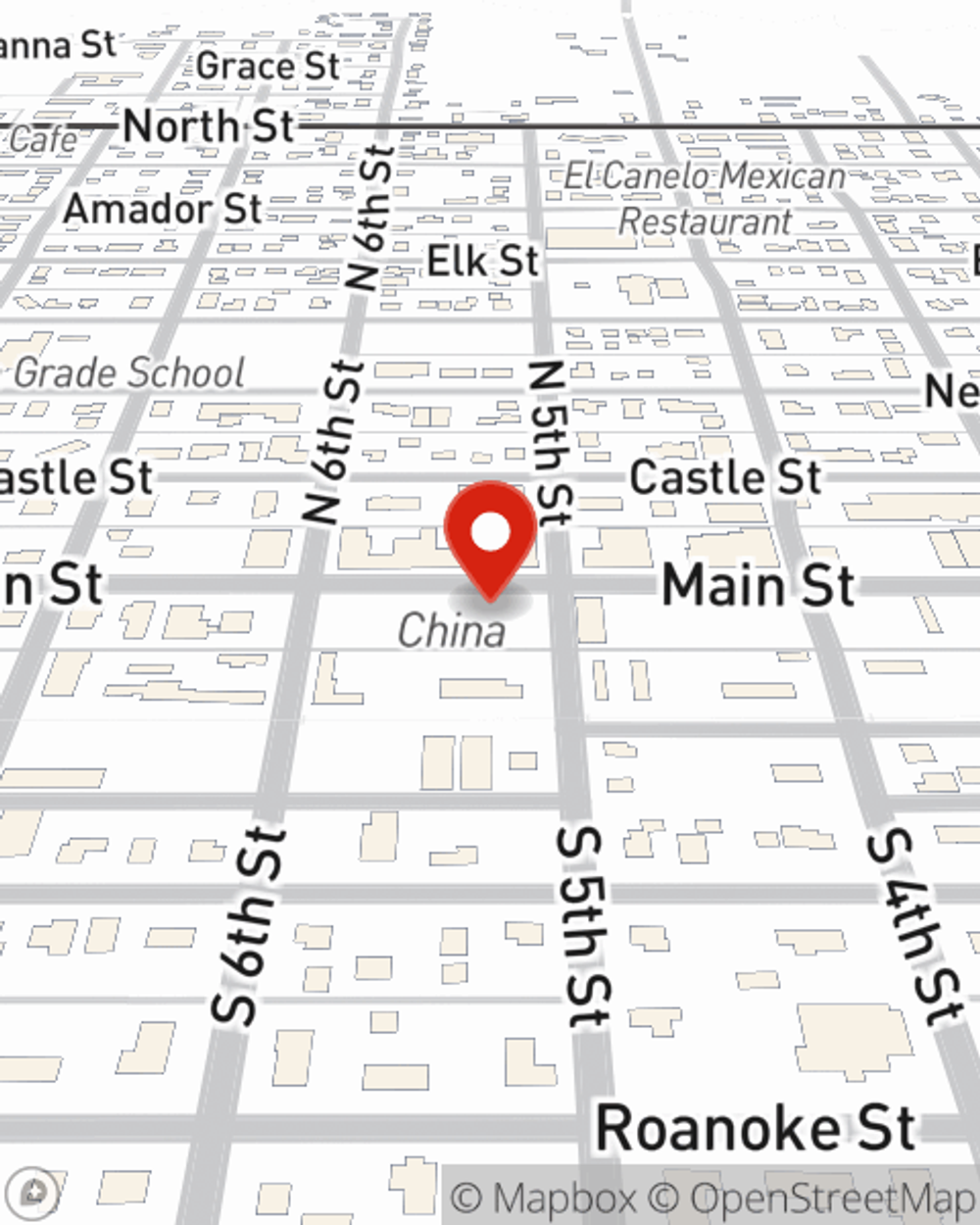

Renters Insurance in and around Seneca

Looking for renters insurance in Seneca?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Seneca Renters!

Trying to sift through coverage options and providers on top of your pickleball league, family events and managing your side business, can be a lot to juggle. But your belongings in your rented townhome may need the incredible coverage that State Farm provides. So when mishaps occur, your tools, sound equipment and souvenirs have protection.

Looking for renters insurance in Seneca?

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

You may be skeptical that having Renters insurance can be beneficial, but what many renters don't know is that your landlord's insurance generally only covers the structure of the home. How difficult it would be to replace your possessions can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

As a dependable provider of renters insurance in Seneca, KS, State Farm aims to keep your valuables protected. Call State Farm agent Tom Hilbert today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Tom at (785) 336-2250 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Tom Hilbert

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.